Elevate Your Corporate Tax Software with AI

Integrate a smart AI assistant into your Corporate Tax Software to revolutionize how businesses manage their taxes. From tax calculations to filing returns, your users will experience unprecedented efficiency and accuracy, enhancing their trust in your solution with Rehance.

Intelligently helps users calculate tax liabilities, optimize tax deductions, and prepare and file tax returns in your app.

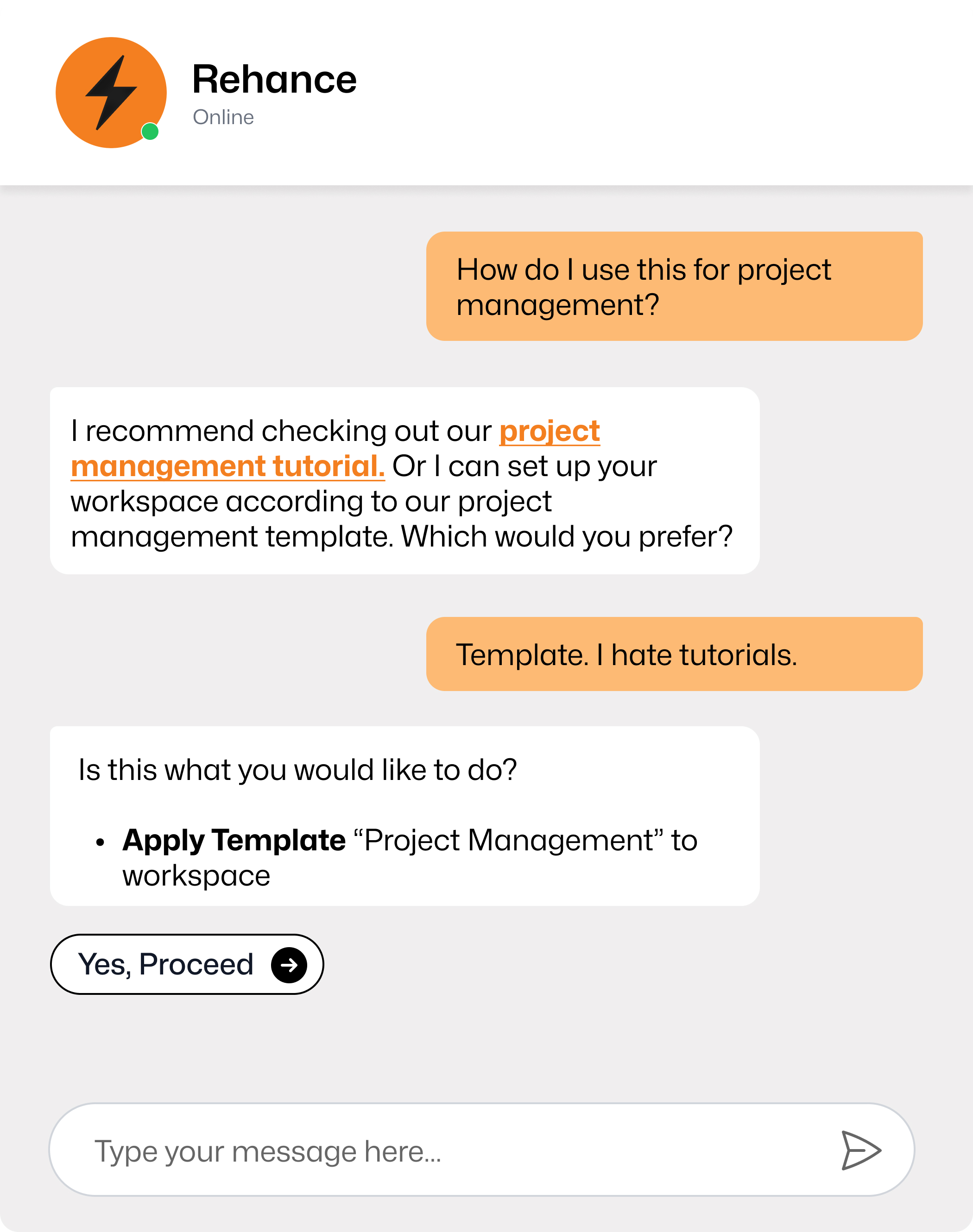

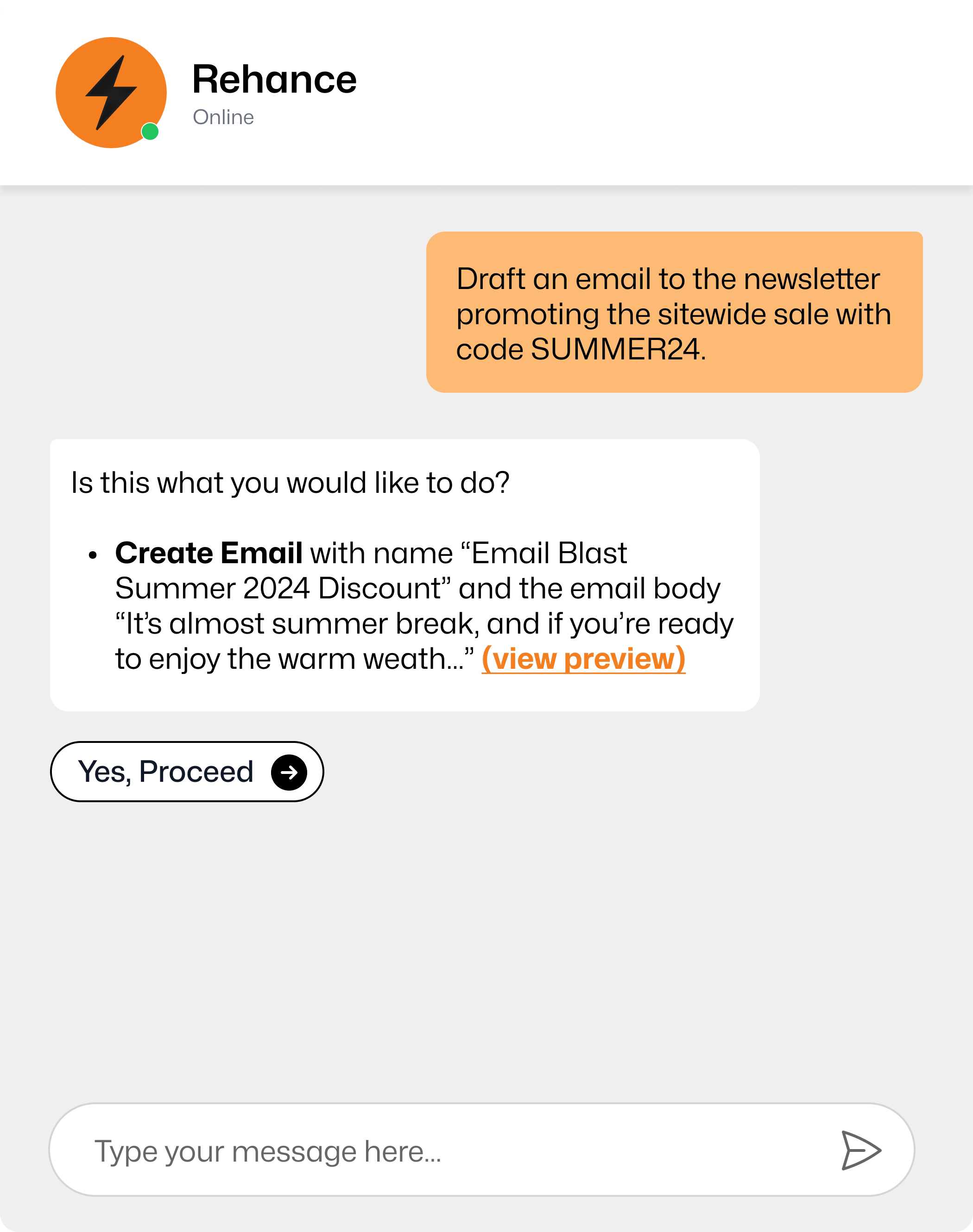

Strictly validates output and requires user confirmation.

Integrate in minutes with our drop-in JS script.

Transforming Tax Challenges into Opportunities...

Navigating the complex world of corporate taxes can be daunting. But with an AI assistant, your users can effortlessly find the guidance and support they need, when they need it.

See every user request and the context around it.

Use the data to improve your app's UX.

Track completion rates and tasks automated for your users.

Beyond Answers, Into Action.

Instead of merely guiding users through a static FAQ, our AI assistant takes proactive steps to resolve their queries - from calculating tax liabilities to optimizing deductions and generating comprehensive tax reports.

Connected to your app's operations. Strictly validated.

Pulls in data from your app's context to make decisions.

Integrated in minutes with our drop-in JS script or via API.

Ready to add AI to your Corporate Tax Software?

Create an account and set up your integration in minutes.

Understanding Corporate Tax Software

Corporate Tax Software is designed to simplify and automate the process of preparing and filing tax returns for businesses. It assists companies in complying with country-specific tax laws, calculating tax liabilities accurately, and maximizing deductions. This software significantly reduces the risk of human error and ensures compliance with ever-changing tax regulations, thereby saving businesses valuable time and resources.

Related: Order Management Software, Accounting Software, Accounting Practice Management Software, Accounts Receivable Software, Accounts Payable Automation Software, Billing Software, Budgeting and Forecasting Software, Cash Flow Management Software, Corporate Performance Management (CPM) Software, Credit and Collections Software, Enterprise Payment Software, Financial Analysis Software, Financial Audit Software, Financial Close Software, Financial Reconciliation Software, Foreign Exchange Software, Freelance Tax Software, Invoice Management Software, Other Finance & Admin. Software, Recurring Revenue Finance Software, Remittance & Money Transfer Software, Revenue Management Software, Sales Tax and VAT Compliance Software, Travel Management Software, Expense Management Software, Mileage Tracking Software, Treasury Management Systems